Not many people consider life insurance options when planning how much money they will take in after they retire. Traditional options and social conditioning typically push the everyday 40-55 year old into a plan that they don’t truly understand. Our goal is to help educate you on what you could be doing with your money. For professionals, individuals, and business owners, different options are needed for different reasons, but life insurance and retirement planning are not “one size fits all.”

We have several different options to choose from, and we will walk you through why one may be better than the other, or better than your existing plan. If you’d like to learn more about what we do, please check out our podcast to get a breakdown of any of our plans or give us a call to talk to Mark directly. We work with people all over to help better navigate retirement income strategies that make sense.

Here are 5 Things to consider as you plan ahead for your retirement.

How Much Do I Need to Retire?

The question that most people start with is How much Do I Need? This purely depends on the individual case. Depending on your lifestyle, estate, and plans for your family after you are gone, this number could vary. Obviously, your income is significant in this equation. Typically experts exclaim you should plan to have around 80% of your final pre-retirement annual income. So if you make $150,000 annually, you will probably need around $120,000 a year to continue living comfortably after leaving the workforce.

When Should I Start Planning for Retirement?

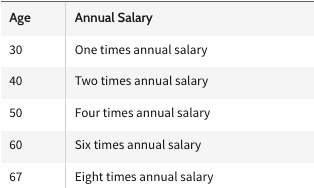

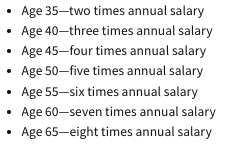

Whether you are a professional, business owner, or standard individual employee, it’s never too early to start planning for your retirement. Fidelity Investments suggests that any person should begin saving in their 20s. They suggest that somewhere around 15% of your gross salary should be saved to some retirement account and any employer contributions if you have access to a 401k or employer-sponsored plan. Over time, if a person begins this process in their 20s, they could have 1X their annual salary by age 30, and 2 by age 40, and so on.

This is obviously only one suggestion, as as we continue to reiterate, every situation is very different, requiring a keen understanding of this process to offer the best solution. A different formula could be considered a bit more aggressive, suggesting you save 25% of your gross salary each year. This formula, if started in a person’s 20s, could help them reach this 8x goal by age 65.

Do I have Enough Saved for Retirement?

If you think you don’t have enough saved, you aren’t alone. Charles Shwab did a survey in 2020 of 401k plan participants who were currently employed. Here’s how that survey broke down when respondents were asked how the fallout from the COVID pandemic will have an impact on their retirement savings.

42% of millennials felt it was “very likely” they would reach their goals, compared to 39% of baby boomers, and 32% of Gen X.

14% of all respondents said that it is “not likely at all” that they reach their retirement savings goals. 49% believed they are “somewhat likely” to do so, and 37% overall felt they are “very likely” to achieve their retirement savings goals.

Life-altering events along the way, are always going to stimy any perfect plan. No matter what you have saved, there are other options beyond just your personal savings that can help you earn more at retirement.

What Are My Retirement Income Options?

There are other options out there beyond 401k and employer-based programs. Roth or Traditional IRA’s also have benefits and drawbacks, but what many people don’t know is how much income could be earned off life insurance. As many people understand, life insurance helps cover your family if something were to happen to you. That is not all.

We highly recommend you review some of our podcast materials, where Mark the expert breaks down how these plans work, and why you need to know how they work. We work to help you understand that the stigma of life insurance is not what life insurance really is in 2021-22. With unexpected events like the pandemic, along with the economic impact of it, there is no better time than now to review your plan for after retirement. If you think this article or any of our blog or podcast materials sparks an idea or question, please don’t hesitate to reach out via our contact form or by phone! We look forward to meeting with you!

Stay tuned here every few weeks for new info on retirement income planning and tax-efficient strategies! Remember to subscribe wherever you listen to podcasts to the MBK Beat, where we update new episodes and always take our time to show you the truth about life insurance.