Here on the blog we like to shed light on the many ways you can earn more from your hard work, with tax efficient insurance strategies. You can count on finding new content here every few weeks, and you can also learn more about this stuff over on the MBK Beat Podcast where we break down plans at length, and how to apply them in the real world. It’s always best to meet with a professional life insurance consultant to find out what you could be doing.. as every case is different. There are shining examples all over however, you may just not know it. We’ve talked on the blog before about how high income earners like NCAA college football coaches utilize split-dollar-life insurance plans as opportunities to earn more, efficiently.

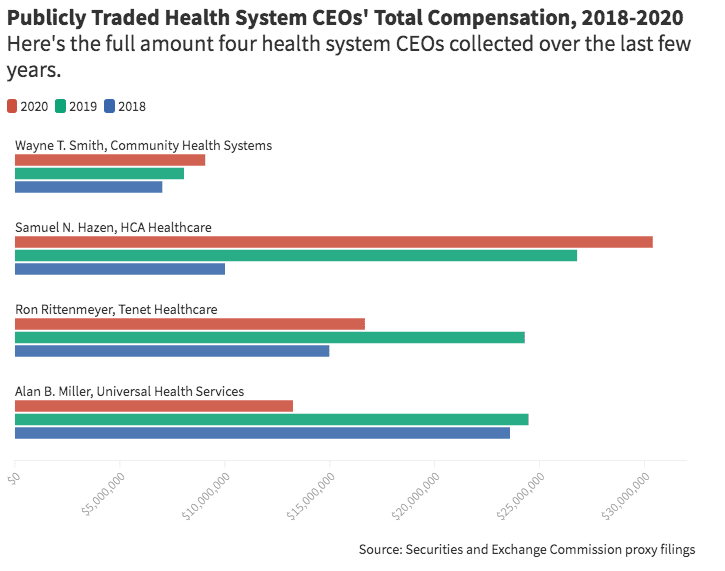

The Securities and Exchange commission proxy filings provide knowledge of what some of the top earners in the Public Health System make year over year, and you can see exactly what adds up to that total. Not everyone in the public health industry made out better in 2020 than 2019, but some did, and there is a correlation to who did and who didn’t.

We’ll take a look at a few highlights courtesy of fiercehealthcare.com

Salary & Executive Benefits

2020’s top earning CEO in the public healthcare industry was HCA Healthcare’s Sam Hazen, who collected about $30.4 million in total compensation for. In 2019, he collected around $26.8 million. The next gainer? Wayne T. Smith of Community Health Systems. He was up from $8.1 million in 2019 to $9.1 million in 2020.

According to the Securities and Exchange Commission proxy filings, 2 out of the top 4 publicly traded health system CEOs were DOWN in total pay from 2019. Not Hazen and Smith.. The chart below demonstrates the last 3 years for each CEO mentioned in the fiercehealthcare article.

All of the CEO’s mentioned faced significant cuts to their salaries, and were forced to make sacrifices.

Wayne Smith’s base salary was $1.3 million in 2020, but he was matched with stock awards, option awards, non-equity incentive plan, change in his pension value and non-qualified deferred compensation. Also included was compensation for life insurance premiums.

Hazen, who topped out the list at $30.4 million received a mere $1.3 million in base salary. He made $13.1 million in stock and stock appreciation rights along with a hefty 12.3 million change in pension value.

Alan Miller from Universal Health Services went back from $24.5 million in 2019 to $13.2 million in 2020, but though he lost about $17 million Year over Year on stock option awards, was still able to receive the same $1.1 million split-dollar-life insurance agreements that he did in 2019.

The bottom line is this…

Executives at the top are the ones that make or break a company. They are the leaders of the pack who must be compensated and provided for, or someone else may try to recruit them. In order to recruit and retain top C-level talent, you must have a plan for executive benefits. We’ve talked on the blog before about how high income earners like NCAA college football coaches utilize split-dollar-life insurance plans as opportunities to earn more, efficiently.

Here at MBK and Associates we understand the ins an outs of executive benefits. We work with executives and professionals to help audit and enhance their portfolios. If you’d like to learn more about what you could be doing, please don’t hesitate to give us a call or reach out via our contact form!